If you’re wondering how to estimate tiny house costs, wonder no more! It’s not as difficult as you may think!

By entering your email address you agree to receive emails from Riding Tiny. We’ll respect your privacy and you can unsubscribe at any time.

How We Saved $11,000 on Tiny House Build Costs

- By Sang Kim

- Updated:

If you are building a tiny house on a budget, every dollar counts. When you are building a tiny home, it’s inevitable that you will spend a lot of money on building materials, appliances, etc.

Even if you thrift and buy used materials, you can only save so much. In this guide, I will show you the exact methods I used to save more than $11,000 (yup, you read that right!) without making any compromises.

Table of Contents

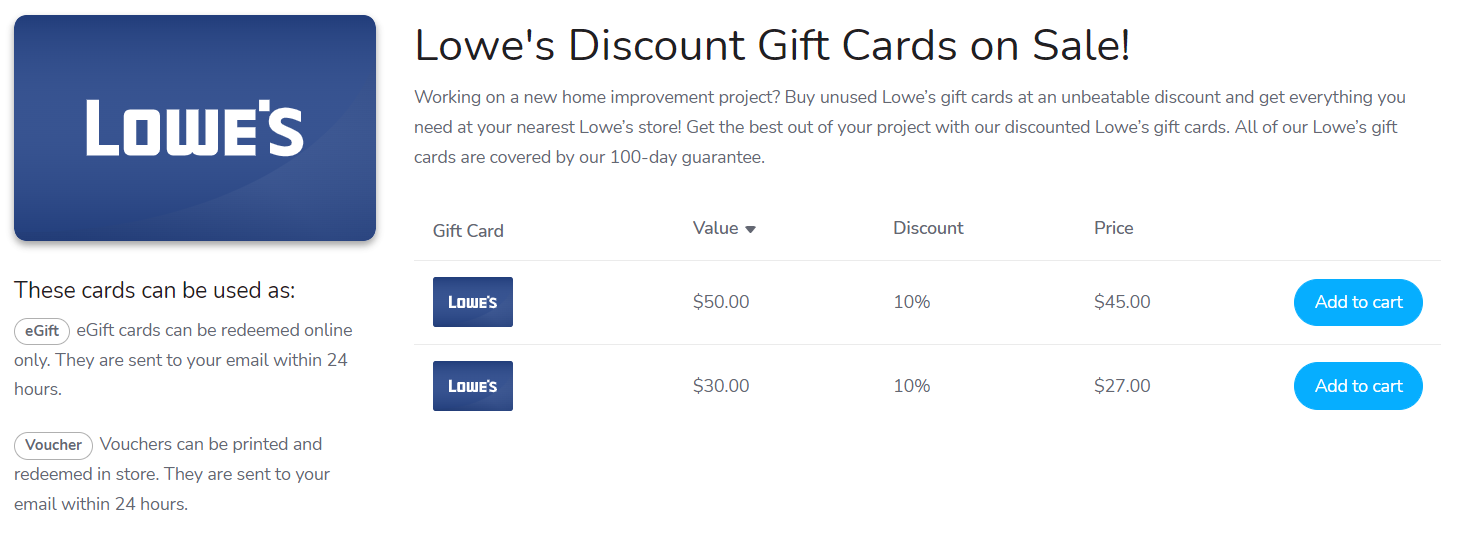

Buy materials using discounted Lowe's and Home Depot gift cards (5%+ savings)

When building a DIY tiny house, you purchase a majority of your materials from hardware stores, mainly Lowe’s and Home Depot.

Although they offer credit cards that let you save 5% on every purchase, we can save even more by buying discounted gift cards online.

You can buy discounted gift cards for stores like Lowe’s and Home Depot from reputable gift card marketplaces such as CardPool, Raise, and CardCookie.

I haven’t had issues buying gift cards from these sites as they do quality control and provide a 100% money-back guarantee. They regularly have more than 5% discounts on gift cards.

Since you will be purchasing this using a credit card, you will be saving at least another 1% in credit card rewards on top of the savings from the discounted gift cards. These discounted gift cards sell fast so purchase them in advance.

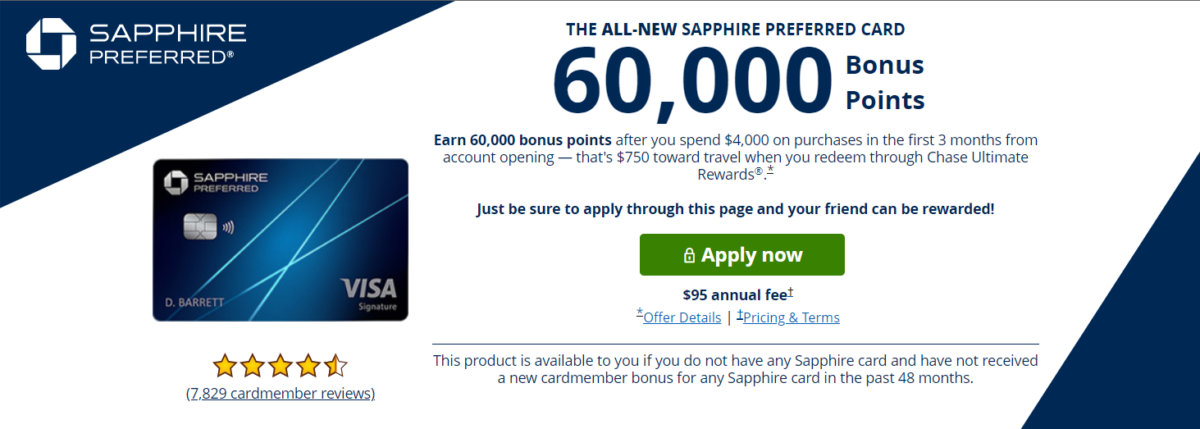

Earn credit card sign-up bonuses (20%+ savings)

We all know that credit card companies give out lucrative signup bonuses. So why shouldn’t we take advantage of them since we spend tens of thousands of dollars on tiny homes?

This method is called credit card churning.

Credit card churning is when you strategically open up a series of credit cards in order to receive huge sign-up bonuses. Once you are done with a signup bonus, you simply “churn” through another signup bonus and repeat.

Sign-up bonuses usually come in a form of statement credits or reward points/miles that you can be redeemed for cash, shopping, or travel. Credit card sign-up bonuses are typically worth around $200 to $750 and have a minimum spending requirement that ranges anywhere from $500 to $4,000.

To put it another way, you are getting around 15% to 25% cashback on your spending. This is the money you would have spent anyway purchasing your materials and you are getting rewarded to do so. Amazing!

For example, the Chase Sapphire Preferred credit card currently gives you 60,000 points ($750 value) after spending $4,000. Direct link to offer

If you are building your tiny house from scratch, this gives you ample opportunity to earn anywhere from 5 to 10 bonuses during the course of your build.

Here are the best credit card bonuses that I received and recommend you get :

- Chase Sapphire Preferred Card – Earn 60,000 points after spending $4,000.

- American Express Gold Card – Earn 60,000 points after spending $4,000.

- Capital One Spark Miles Business Card – Earn 50,000 miles after spending $4,500.

- Delta SkyMiles® Gold Card – Earn 70,000 miles after spending $2,000.

- Blue Cash Everyday Card – Earn $200 after spending $2,000.

- Blue Cash Preferred Card – Earn $300 after spending $3,000.

- Capital One Venture One Card – Earn 20,000 miles after spending $2,000.

Does opening up credit cards hurt my credit score?

Yes, temporarily. No, in the long run.

A credit score is determined by a variety of factors including a number of credit inquiries. However, since credit score is more heavily influenced by your credit utilization (amount of credit used/total available credit), as you sign up for more cards, your available credit will go up, thereby decreasing credit utilization which increases your credit score.

Before I started churning credit cards, my FICO score was 740 but after opening up 12 credit cards, I am at 800 after two years. It went up.

What about the annual fee?

Credit cards with high signup bonuses will typically have annual fees. This is to entice consumers with an appealing offer and hope for customer retention, which generates revenue through swipe fees and annual fees.

However, almost all credit cards have a product change option that allows you to change them to no annual fee cards.

Once you downgrade it, you no longer pay the annual fee but keep your credit card open which will help improve your credit score. There is no fee involved in product changing your credit card and you do it by calling the number on the back of your card.

Earn bank sign-up bonuses

Similar to credit card sign-up bonuses, you can earn various bank sign-up bonuses and use the savings to put it towards your tiny house spending.

Most bank sign-up bonuses reward you with a cash bonus of $200 to $500 for opening up a checking account with them. To earn the bonuses, you typically have to set up a direct deposit and park the money with them for a few months.

Unlike applying for credit cards, opening up bank accounts does not affect your credit score. This is because they do a soft inquiry on your credit report instead of a hard inquiry and don’t report bank accounts to credit bureaus.

Here is an example of a bank signup bonus. OnJuno is currently offering a $100 signup bonus and a $50 signup bonus if you set up a one-time $250+ direct deposit. Link to offer

Just like the way we earn credit card signup bonuses, once you are done with a bank bonus, you can keep/close the account, and move on to the next one. Make sure to read any fine prints to avoid any monthly fees or closing fees, if there are any.

On average, it takes 10-30 mins to sign-up and complete the requirements for the bonus. Putting that into perspective, you are making more than what most doctors make in an hour. I would say that’s a pretty good ROI.

Here are the best bank bonuses that I curated for you. You can work on any of these bank bonuses in no particular order :

- Truist – Earn $500 after $1,000 direct deposit.

- Wells Fargo – Earn $300 bonus after $1,000 direct deposit.

- American Express – Earn $300 after depositing $5,000.

- MoniFi – Earn $250 bonus after two $1,000 direct deposits.

- OnJuno – Earn up to $150 bonus after $250 direct deposit.

- Chime – Earn $100 bonus after $200 direct deposit.

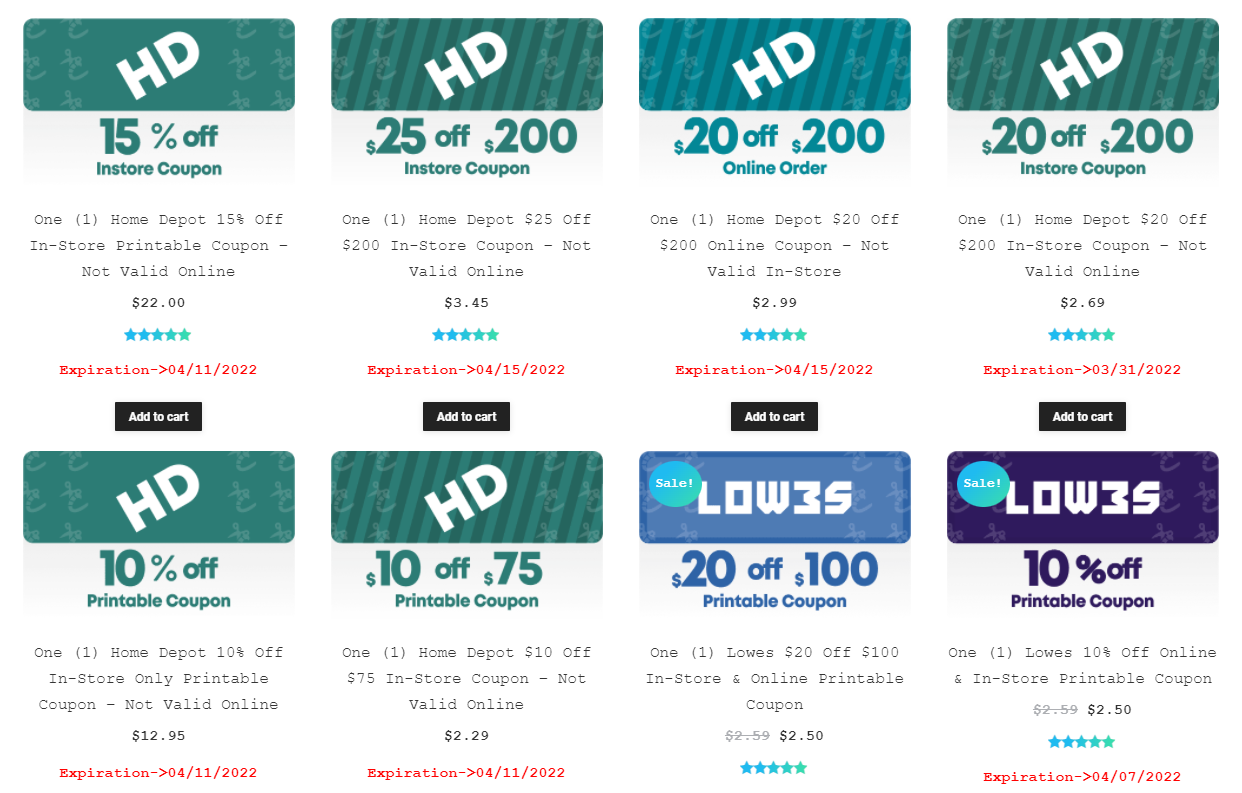

Use Home Depot and Lowe's discount coupons (15%+ Saving)

Lowe’s and Home Depot run promotions where they give out 10% to 20% off coupons. Traditionally, you would get these coupons via promotions or through the mail.

But lucky for us, there are third-party websites that sell these coupons for only a couple of dollars. I’ve used a number of them and I haven’t had any issues applying the coupons to my Home Depot and Lowe’s purchases.

I personally enjoyed using Hugeoff.com. The coupons are only a few dollars and get sent to your email immediately upon purchase.

As an example, let’s say you buy a $20 off $100 Lowe’s coupon. After taking the cost of the coupon into consideration, you’re looking at $17.5 off a $100 on Lowe’s purchases. That’s a whopping 17.5% off your entire order.

To use these coupons, just checkout as usual and show the cashier the coupon so he/she can scan it. If you’re purchasing materials online, you can copy and paste the discount code to the promo code box when checking out.

Putting everything together

So how did we save $11,000+ on our tiny home build costs? Here’s how:

First, we (my girlfriend and I) both opened up credit cards to earn multiple huge sign-up bonuses. To meet the minimum spending requirement, we used the recently opened credit cards to purchase discounted Lowe’s and Home Depot gift cards on online gift card exchanges.

We then purchased Lowe’s and Home Depot discount coupons from Hugeoff.com and eBay. Finally, we broke down our purchases into smaller amounts to best take advantage of the discount coupons whenever we could.

That’s it! If you follow these exact steps, you will save thousands of dollars depending on your total build costs.

Thanks for reading and if this post was helpful. Please feel free to share it!

Interested in our build costs and step-by-step tiny house construction guide? Check out the links below:

By entering your email address you agree to receive emails from Riding Tiny. We’ll respect your privacy and you can unsubscribe at any time.

Do you need help choosing the best tiny home trailer for your tiny home? We’re here to help you decide on your tiny home trailer.

There are many options to choose from when it comes to tiny house roof. But there is a clear winner. Learn all about it in this post!

How do you wire tiny house electrical? In this post, you will everything from tiny house electrical basics to wiring your home step-by-step.

Have you wondered how much it costs to live in a tiny home, per month? Well I go over the numbers and spill all the juice. Check it out!

A stable foundation ensures a strong tiny home. Let’s learn what goes into making a sturdy tiny foundation!